Just how long are mortgages fantastic for in Florida? The commonest mortgage loan conditions are 30-calendar year- and 15-calendar year set-fee mortgages. A thirty-12 months fastened-charge mortgage features reduced every month payments but accrues extra fascination after a while. In distinction, a fifteen-yr set-price mortgage entails higher regular payments but can save you countless numbers in desire by chopping the repayment time period in 50 %. Who regulates mortgages in Florida? The Business office of monetary Regulation in Florida regulates mortgages from the condition and ensures that the costs comply with condition and federal legislation. Exactly what is a mortgage named in Florida? The Florida mortgage fees are also referred to as Purchase Income Security Fascination or PMSI. It is actually named so as the money is obtainable exclusively to acquire a household assets on a mortgage.

Gina Freeman is actually a senior editor about the Credit Cards, Loans and Banking workforce at U.S. News & Globe Report. She enjoys breaking down difficult funds topics and assisting consumers experience snug building fiscal decisions. An acknowledged expert masking mortgages and personal finance matters considering that 2008, Gina's Skilled qualifications incorporates mortgage lending and underwriting, tax accounting, bankruptcy law and credit bureau units consulting.

APR 1 The annual proportion level (APR) signifies the accurate annually Price within your financial loan, which includes any service fees or charges As well as the particular interest you shell out towards the lender. The APR can be enhanced or diminished once the closing date for adjustable-charge mortgages (ARM) financial loans.

The charges and every month payments shown are based upon a mortgage volume of $464,000 and a deposit of at least 25%. Find out more about how these fees, APRs and regular payments are calculated. Furthermore, see a conforming set-fee approximated every month payment and APR case in point. Get more particulars.

Getting your to start with property can be In particular daunting, but you may be ready to qualify for some excess assist to simplicity your problems from Florida Housing, the state’s housing finance authority.

Inside a consulting capability, he has assisted folks and corporations of all dimensions with accounting, economical preparing and investing matters; lent his financial experience to a few well-known Web sites; and tutored students via a few Digital community forums. Read through more About our review board Shut Thomas Brock, CFA, CPA, Verified Badge Icon

Step five: Get preapproved to get a mortgage - Obtaining a mortgage preapproval is the one way to get exact personal loan pricing for your personal precise circumstance.

The Federal Reserve's current financial plan, Primarily mainly because it pertains to bond shopping for and funding govt-backed mortgages

Bison State Lender is a Local community bank that provides personalized service and aggressive charges for many different home financial loan forms.

Macroeconomic factors kept the mortgage current market reasonably very low for Considerably of 2021. Specifically, the Federal Reserve were purchasing billions of pounds of bonds in reaction to your pandemic's economic pressures. This bond-buying plan is A significant influencer of mortgage costs.

Have an understanding of the lender’s flood prerequisites. The home you find yourself getting may be situated in a flood zone or other higher-hazard spot. Prior to committing into a lender, ensure you understand its demands to make sure you’re capable to acquire the funding you will need.

For its 1st meeting of the new calendar year, however, the Fed opted to keep fees continuous—and it’s attainable the central bank may well not make A further level Slice for months. With a total of 8 amount-environment conferences scheduled every year, that means we could see multiple level-maintain bulletins in 2025.

The prices we publish won’t Evaluate right with teaser costs the thing is advertised online given that People costs are cherry-picked since the most engaging vs. the averages you see here. Teaser rates may contain shelling out factors upfront or may very well be dependant on a hypothetical borrower by having an ultra-higher credit history score or to get a lesser-than-regular bank loan.

The every month payment shown is produced up of principal and curiosity. It does not florida delayed financing incorporate amounts for taxes and insurance plan rates. The regular payment obligation will be higher if taxes and insurance policy are provided.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Marla Sokoloff Then & Now!

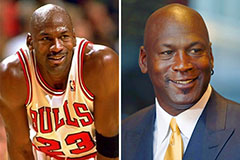

Marla Sokoloff Then & Now! Michael Jordan Then & Now!

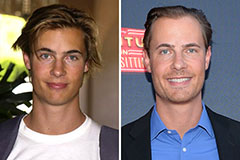

Michael Jordan Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!